私人股本行业正经历前所未有的资金流入和投资活动。鉴于我们在这一领域的长期专注,亿康先达有得天独厚的条件帮助企业解决不断增长的相关需求。几十年来,无论是从欧洲、美国、亚洲还是其他地方开始,我们一直是希望从本土扩张到新地区的私募股权公司最信任的合作伙伴。

近年来,我们看到越来越多的外国公司在美国设立分支机构,第一次分支机构雇佣全新的团队,现有的公司筹集新的更大的基金,部署额外的策略(例如,特殊情况、成长型股票和信贷工具)。我们注意到,许多有限合伙人组织的行为更像普通合伙人,发展自己的投资能力。与此同时,人才市场的流动性也比以往任何时候都要大。

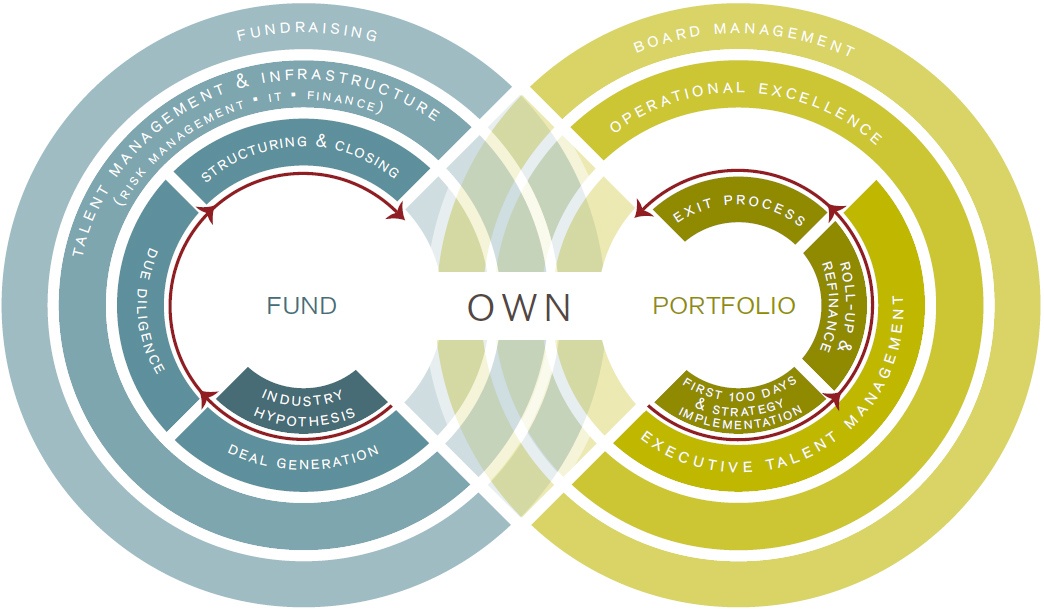

私人股本的人才来源有两个不同的方面。在基金层面,实体需要高水平的领导者,涵盖一整套角色:投资专业人士、运营合伙人、高级顾问和职能领导,如人力资源、投资者关系、资本市场、乐动ldsports ,咕咕地叫.在投资组合层面,最高管理层和板位置在所有行业都有很高的需求。对于这些高度区域化的业务,我们可以在实践中利用我们深厚的本地和部门专业知识(消费者,卫生保健,金融服务,技术/通信,工业) -都与他们的PE同行保持一致。

这些行业动态与亿康先达的理想一致一个公司模型。我们的地理和行业广度(包括ldsports乐动 跨越35个国家)和深厚的专业知识(我们超过525年乐动咨询公司几乎全部从行业雇佣,所以我们了解普遍的问题)使我们能够提供不同国家的独特的赞助商覆盖。尽管其他咨询公司也可能提供单一联络点来支持多个地区的项目,但在亿康先达,这种结构是无缝和有机的。

尽管有大量的经济激励措施将人才与现有的商店捆绑在一起,但投资组合的迅速扩张为年轻的顶级人才提供了一个诱人的市场。这使得私募股权管理团队有责任主动、系统地管理他们的人才,包括领导层的继任。这是亿康先达擅长的另一个领域,它在金融服务垂直领域拥有丰富的经验。

我们欢迎有机会通过亿康先达的专业知识和综合服务方式,帮助私募股权管理团队体验真正的本地伙伴关系。